Author Archives: Deadly Clear

The Truth is Out – Parasites Have Been Driving Cancers and Most Diseases in Our Bodies

This post started when a little known lawsuit was filed against a health center in Hana, Hawaii alleging that the health center that sold fresh produce and a variety of lettuces for organic salads was infested with rat lungworm (RLW) that a patron (who is also the Plaintiff) ingested and “began to show the initial signs of Angiostrongylus sickness almost immediately, and became extremely nauseous, vomiting, within a couple of hours of consumption.”

There’s a solution, yet it’s being kept hidden from us. Who benefits from this secrecy?

ask Physicians Across America

The Plaintiff went in to see the doctors at “the community health center, and then eventually to Maui Memorial Hospital (over 2 hours away) for complications described as Atrial fibrillation. Luckily, the RLW was diagnosed by Dr. Curtis Bekkum in Hana, who specializes in blood disorders and parasite disease, as well as parasite cleansings. Over the next two months, the Plaintiff’s health spiraled downward to the point where he was practically paralyzed for two months, trapped in a body of excruciating pain. He could not walk or stand.”

Continue readingMaui ‘Ground Zero’ for Release of Billions of Biopesticide Lab-Altered Mosquitoes

By Michael Nevradakis, Ph.D.

the Defender, Children’s Health Defense

Up to 775,992,000 bacteria-infected mosquitoes could be released in Maui every week for the next 20 years, according to Hawaii Unites, a nonprofit that last month lost its bid to require the state to conduct an environmental impact statement before pressing go on the controversial project. the Defender, Feb. 6, 2024

Hawaii Unites in May 2023 sued the state in the Circuit Court of the First Circuit in Hawaii. The group’s president and founder, Tina Lia, told The Defender:

Continue readingFed’s Easy Money Fallout: Investors are Completely Unaware of This Leverage

Uncover the secretive realm of Private Equity (PE), a financial powerhouse born in the shadows of the ’40s. A power shift between fund managers and investors is shaking Wall Street, raising questions about market stability. 🏛️ As the private equity scam unravels, risk transfers from elites to “mini-millionaires,” potentially triggering the next financial crisis. 📉 Stay vigilant to navigate this financial maze and safeguard your interests.

The more you know. . .

Have You Figured Out Why Ivermectin Works, Yet?

Reply

There is so much to learn, so much to research, and so much to search in your soul for what is truth, fact, and/or fiction. The following videos are a good start to begin to understand what we need to know and what to do about it.

“The New Parasite Paradigm (is probably the key to everything, For the Vaxxed, for the Unvaxxed). Here is an explanation of the natural and synthetic parasites we are facing, and a guide to the three things you need to do to protect yourself and your family…”

Continue readingThe Great Taking

The Great Taking concisely explains what every American Homeowner and students who were pushed loans knew about the fraudulent securitization scheme. Homeowners tried to tell the courts and state attorneys general that these loans were not mortgages – but actually securities, and that the UCC laws had been changed in the mid 1990s which allowed the thieves to prevail in the pilferage of properties while the thieves wiped out the pension systems worldwide. Scroll down (they make it difficult for Rumble videos).

Take an hour and watch The Great Taking because whether or not you own a home or rent one – what is coming will directly affect you and you’ll want to be prepared.

“‘The Great Taking’ is a not-for-profit documentary produced by former hedge fund manager, David Rogers Webb, which alerts us to the privately-controlled Central Banks’ preparations for the inevitable financial collapse.

Continue readingHow Tourists Escaped A Fiery West Maui After The Blaze

By Kirstin Downey, reporter for Civil Beat.

“Normally thousands of visitors would be in the tourist mecca on any given day. But an organized effort by tourism officials helped get them out.”

An amazing account of the heroes behind the scenes that you haven’t heard about.

“Even as the fires in Lahaina were still burning, even before top state officials knew the magnitude of the disaster, a handful of tourism managers on Maui moved quickly to orchestrate an airlift of some 12,000 visitors off the island and out of harm’s way.”

Continue readingThe Final Interview with Foreclosure Defense Expert Neil Garfield

This is a must listen to excellent interview with Neil Garfield by attorney Lance Denha and every American Homeowner must share with their local and federal political representatives. Neil is completely frank about the fraudulent securitization system. Neil left us with incredible truths about the foreclosure (aka land grab) system used by the makers and sellers of these fraudulent financial products.

Neil Garfield knew the “system”. He had worked in it – and he recognized the blatant fraud years ago. He set out his entire life to helping homeowner victims that were sold fraudulent financial products aimed at destroying middle class Americans. The system was rigged, the courts were complicit, the foreclosure attorneys sold their souls.

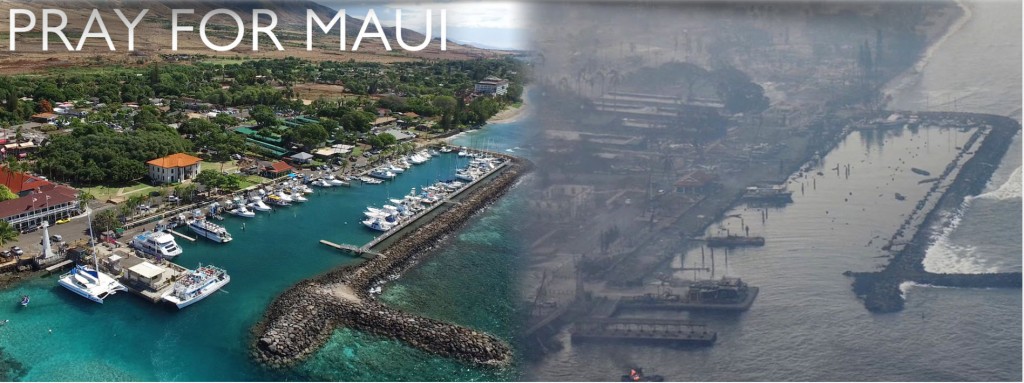

Continue readingMaui, Hawaii Fires, Red Flags, Fundraising and Donations

By Sydney Sullivan

The devasting fires of August 8, 2023 cannot be accurately described in just words.

The array of feelings range from tremendous pain and sorrow, depression, PTSD, and shell-shocked to being too pissed to cry. People want answers and when they don’t get honest or straight answers, the void gets filled with all sorts of chaotic theories – many of which may be real and others just sensational “news” to get views. The truth is, we just don’t know all of the facts yet or reasons for some of the asinine statements or actions from people we’re supposed to trust.

There is a lot to take into consideration here, who, what, where and why??? – and these are not easily answered questions. Maui is a melting pot of cultures and nationalities that love and celebrate each other bringing a whole new meaning to pot luck. The children are some of the most beautiful ever seen.

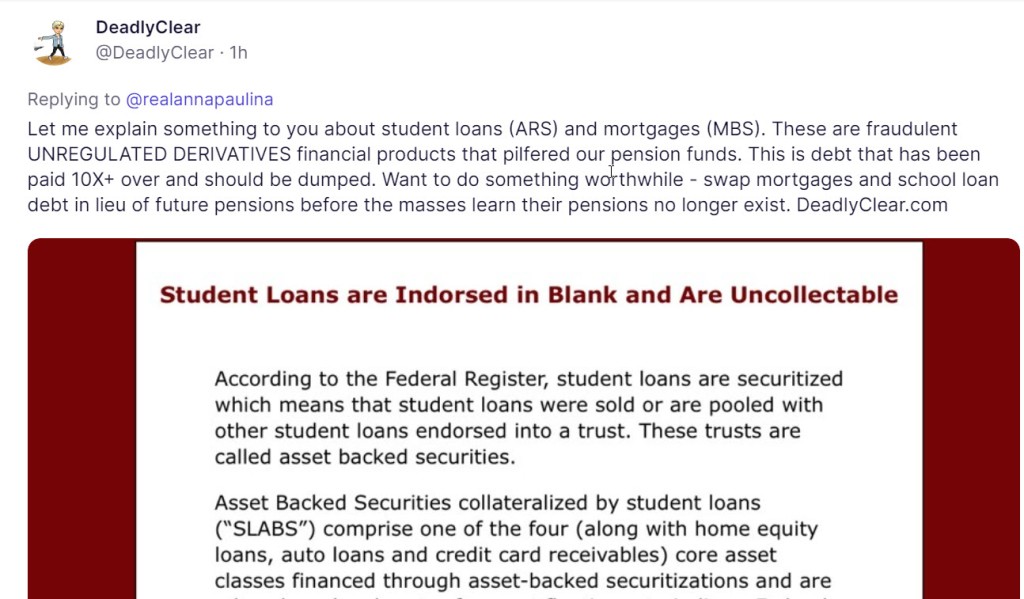

Continue readingStudent Loans are Indorsed in Blank and Are Uncollectable

See: Impact of Securitization and securitization-a-primer/

According to SEC rules student loans are supposed to be transferred into a trust; however they never actually deliver the note. If the note is NOT indorsed into the trust the note is void and uncollectable.

Continue reading