By Susie Madrak, January 18, 2013

‘Breaking The Law Should Not Be A Business Expense’

In the past, federal regulators have been known to include provisions that waived the ability of a company to write off the costs of a settlement. But since our banks are always considered Too Big To Fail, they are of course offered every consideration, and We the People will end up paying for this. That doesn’t sit well with me, and probably not with you, either:

Big Banks Get Tax Break On Foreclosure Abuse Deal

WASHINGTON (AP) — Consumer advocates have complained that U.S. mortgage lenders are getting off easy in a deal to settle charges that they wrongfully foreclosed on many homeowners.

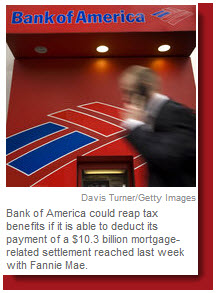

Now it turns out the deal is even sweeter for the lenders than it appears: Taxpayers will subsidize them for the money they’re ponying up.

The Internal Revenue Service regards the lenders’ compensation to homeowners as a cost incurred in the course of doing business. Result: It’s fully tax-deductible.

Critics argue that big banks that were bailed out by taxpayers during the financial crisis are again being favored over the victims of their mortgage abuses.

“The government is abetting the behavior by not preventing the deduction,” said Sen. Charles Grassley, R-Iowa. “The taxpayers end up subsidizing the Wall Street banks after the headlines of a big-dollar settlement die down. That’s unfair to taxpayers.”

“The government is abetting the behavior by not preventing the deduction,” said Sen. Charles Grassley, R-Iowa. “The taxpayers end up subsidizing the Wall Street banks after the headlines of a big-dollar settlement die down. That’s unfair to taxpayers.”

Under the deal, 12 mortgage lenders will pay more than $9 billion to compensate hundreds of thousands of people whose homes were seized improperly, a result of abuses such as “robo-signing.” That’s when banks automatically approved foreclosures without properly reviewing documents.

Regulators reached agreement this week with Goldman Sachs and Morgan Stanley. Last week, the regulators settled with 10 other lenders: Bank of America, JPMorgan Chase, Wells Fargo, Citigroup, MetLife Bank, PNC Financial Services, Sovereign, SunTrust, U.S. Bank and Aurora.The settlements will help eliminate huge potential liabilities for the banks.

I have to wonder: Does this do anything at all to help homeowners with zombie titles?

I have to wonder: Does this do anything at all to help homeowners with zombie titles?

Many consumer advocates argued that regulators settled for too low a price by letting banks avoid full responsibility for wrongful foreclosures that victimized families.

That price the banks will pay will be further eased by the tax-deductibility of their settlement costs. Companies can deduct those costs against federal taxes as long as they are compensating private individuals to remedy a wrong. By contrast, a fine or other financial penalty is not tax-deductible.

Taxpayers “should not be subsidizing or in any way paying for these corporations’ wrongdoing,” said Phineas Baxandall, a senior tax and budget analyst at the U.S. Public Interest Research Group, a consumer advocate.

[…] At least one lawmaker, Sen. Sherrod Brown, D-Ohio, wants regulators to bar the tax deductibility of the lenders’ costs. Brown made his argument in a letter to Federal Reserve Chairman Ben Bernanke, U.S. Comptroller of the Currency Thomas Curry and other top regulators. The Fed and the comptroller’s office, a Treasury Department agency, negotiated the foreclosure abuse settlements with the banks.

[…] At least one lawmaker, Sen. Sherrod Brown, D-Ohio, wants regulators to bar the tax deductibility of the lenders’ costs. Brown made his argument in a letter to Federal Reserve Chairman Ben Bernanke, U.S. Comptroller of the Currency Thomas Curry and other top regulators. The Fed and the comptroller’s office, a Treasury Department agency, negotiated the foreclosure abuse settlements with the banks.

“It is simply unfair for taxpayers to foot the bill for Wall Street’s wrongdoing,” Brown wrote in the letter dated Thursday. “Breaking the law should not be a business expense.” Read more on Huffington Post.

_______________________________________________________________

NY Times – Paying the Price, but Often Deducting It – By Gretchen Morgenson

NY Times – Paying the Price, but Often Deducting It – By Gretchen Morgenson

However, tucked away in these settlements is a problem: the costs are tax-deductible. As the New York Times’ Gretchen Morgenson explained, “the banks can claim them as business expenses. Taxpayers, therefore, will likely lighten the banks’ loads.” At least two U.S. senators think that taxpayers shouldn’t have to cover the cost of the banks’ mistakes.

“Senator Charles Grassley, the Iowa Republican who is a senior member of the Senate Finance Committee, has been critical of favorable tax treatments of settlements. I asked him last week about the issue as it relates to mortgage settlements.

“You can be sure the Wall Street banks consider tax consequences in negotiations and the government should, too,” he said. “Any portion of a settlement that’s intended to be a penalty should include language clarifying it isn’t deductible. Otherwise, the government’s punishment will have less sting than intended.”

IT is to be expected that corporations, like any taxpayers, will do what they can to reduce their tax bills. And a 2005 report from the Government Accountability Office suggests that tax benefits in settlements are prevalent. Examining more than $1 billion in settlements made by 34 companies, the G.A.O. found that 20 had deducted some or all of the money from their tax bills.

But as Mr. Grassley suggested, the government can take deductibility off the table as an option. And occasionally it does. For example, a Justice Department spokesman said that there would be no deductibility of the $500 million penalty and fine portion of the settlement reached with UBS last month in regards to manipulation of interest rates.

Certainly, a settlement’s punitive effect is lessened by any tax sweeteners it generates. Perhaps that’s why it is rarely clear from the public announcements that some or all of the settlement amounts will be deductible. [. . .]

CONGRESS has tried to change this setup. In 2003, Mr. Grassley and two other senators introduced the Government Settlement Transparency Act.

CONGRESS has tried to change this setup. In 2003, Mr. Grassley and two other senators introduced the Government Settlement Transparency Act.

It would have required that payments made by companies acknowledging actual or potential violations of a law would not be tax-deductible. The legislation never passed.

Bills have also been introduced in Congress that would bar deductibility on punitive damage awards arranged among private parties. Those have died, too. Past administrations have supported this idea, and the Obama administration has a proposal in its 2013 budget stating that no deduction would be allowed in such a circumstance. That proposal also states that when an existing insurance policy covered the payment of punitive damages, the amount paid would be considered income to the insured person.

Not a bad idea.

As settlements for corporate misdeeds pile up, perhaps it will get some traction.”

What do you think? Is it time for Congress to make the Wall Street bank frauds settlement deals non-deductible expenses? Hey, think about it – we can only deduct half of a business lunch – and that’s a legal activity!

If these settlement deals are made non-deductible expenses maybe they should be made non-dischargeable debts in bankruptcy too?