The Federal Deposit Insurance Corporation (FDIC) chairman serves at the pleasure of the President of the United States. During the financial crisis of 2008, Sheila Bair was chairman of the FDIC and was a member of a very small club: competent crisis-era financial regulators. Bair was one of the primary policymakers in Washington, DC during the 2007–2009 financial force majeure.

It was during that time many banks and pretender lenders failed, including IndyMac Bank, FSB and Washington Mutual aka “WaMu”. Deals were contrived between banks by the FDIC as it stepped in as receiver to peel off assets making Master Purchasing Agreements between parties.

It was during that time many banks and pretender lenders failed, including IndyMac Bank, FSB and Washington Mutual aka “WaMu”. Deals were contrived between banks by the FDIC as it stepped in as receiver to peel off assets making Master Purchasing Agreements between parties.

In some cases, like IndyMac and WaMu, these deals were struck before a bank could seek reorganization under bankruptcy protection. These “deals” included sealing documents that it appears pertain to sale agreements and the operations of the banks that probably should have led to a Securities and Exchange Commission investigation – rather than covering up the potential for fraud under court seal of, as it appears, the “Unassigned Records” as in the case of IndyMac.

Sealing pertinent documents relating to the acquisition and operations of a failing bank does not bury the body of fraud and deception. These ugly hammers tend to rise out of the grave and drop right back into the lap of those who tried their darnedest to it cover up.

Sealing pertinent documents relating to the acquisition and operations of a failing bank does not bury the body of fraud and deception. These ugly hammers tend to rise out of the grave and drop right back into the lap of those who tried their darnedest to it cover up.

Such is the case in the WaMu’s JOLLEY v. CHASE HOME FINANCE, LLC decision filed February 11, 2013. Homeowner Plaintiff Scott Call Jolley appealed a lower court decision in the Court of Appeals of California. A major point given to Jolley dealt with a purchase and assumption agreement (Agreement or P&A Agreement) between the FDIC, as receiver for the failed WaMu and JPMorgan Chase. Chase filed a motion for judicial notice that requested “the Court to take judicial notice pursuant to California Evidence Code Sections 450-460” of the “39 page P&A Agreement” stating:

“1. On September 25, 2008, Washington Mutual Bank, _.A. (“WaMu”) was closed by the Office of Thrift Supervision, and the Federal Deposit Insurance Corporation (FDIC) was named Receiver for WaMu pursuant to its authority under the Federal Deposit Insurance Act, 12 U.S.C. § 1821(d). Pursuant to the Purchase and Assumption Agreement between the FDIC as Receiver for WaMu, and Chase, dated September 25, 2008, Chase acquired certain of the assets of WaMu, including all loans and loan commitments of WaMu. A copy of that Purchase and Assumption Agreement is attached hereto as Exhibit A and can be found on the FDIC’s website at http://www.fdic.gov/about/freedom/Washington_Mutual_P_and _ A.pdf.” The attached copy was 39 pages, including exhibits. No separate points and authorities accompanied Chase’s request for judicial notice.

Jolley filed opposition to the Chase motion. He also objected to the request for judicial notice as to the P&A Agreement, and filed points and authorities supporting his position disputing that the 39-page Agreement was the complete document governing Chase’s purchase of WaMu.

Jolley produced a sworn declaration of Jeffrey Thorne after a deposition [click here for PDF]. Thorne had been a “senior construction loan consultant” with WaMu until July of 2006 and in charge of construction lending in 38 states since May 2005. He was an “asset manager for the FDIC” at the time he signed the declaration (October 2011), and was “intimately familiar with the procedures for taking over a failed bank.”

Jolley produced a sworn declaration of Jeffrey Thorne after a deposition [click here for PDF]. Thorne had been a “senior construction loan consultant” with WaMu until July of 2006 and in charge of construction lending in 38 states since May 2005. He was an “asset manager for the FDIC” at the time he signed the declaration (October 2011), and was “intimately familiar with the procedures for taking over a failed bank.”

Thorne claimed there was a longer document that had never been made public and its provision governing assumption of liability was different. Thorne declared under penalty of perjury:

“Pursuant to the public part of the agreement with the FDIC, of which were approximately 36 pages, the balance of the contract and the complete agreement with the FDIC and Chase bank is 118 pages long which has not been made public. I am familiar with this agreement, I read it.”

Only the partial 39 pages of the PURCHASE AND ASSUMPTION AGREEMENT appear on the public FDIC website. The court states in its order: “In November 2011, Jolley began trying to secure a copy of the  118-page agreement referred to in Thorne’s declaration. His counsel requested a copy from the FDIC, and also apparently served a subpoena duces tecum seeking production of it. According to Jolley’s counsel, the FDIC refused to produce the document unless all parties to the litigation signed a confidentiality agreement. On November 9, 2011, six days before the motion was to be heard, Jolley requested that counsel for Chase sign a confidentiality agreement. She refused to do so. On or about November 14, 2011, Jolley filed an ex parte application seeking to continue the motion, to keep discovery open, and to continue the trial date so that further efforts could be made to obtain the longer agreement.”

118-page agreement referred to in Thorne’s declaration. His counsel requested a copy from the FDIC, and also apparently served a subpoena duces tecum seeking production of it. According to Jolley’s counsel, the FDIC refused to produce the document unless all parties to the litigation signed a confidentiality agreement. On November 9, 2011, six days before the motion was to be heard, Jolley requested that counsel for Chase sign a confidentiality agreement. She refused to do so. On or about November 14, 2011, Jolley filed an ex parte application seeking to continue the motion, to keep discovery open, and to continue the trial date so that further efforts could be made to obtain the longer agreement.”

What would be the purpose of covering up a Purchase Agreement? Unassigned mortgage loan records, maybe? Maybe all of the unassigned mortgage loans allegedly sold to the trusts are noted in the “sealed” records… Oh, what a wicked web we weave – when first we practice to deceive.

Luckily, for Jolley the court recognized the necessity to view the 118-page Purchase Agreement. Maybe that’s because WaMu was notorious for offering the same loans in multiple trusts. Just a random survey of WaMu 2006-2007 trusts [CLICK HERE FOR FULL REPORT] turned up over 500 loans in 2 or more trusts. Matt Taibbi was just scratching the surface on what the SEC wasn’t on top of! [Click here for Madoff and the “Aggressively Clueless” SEC].

Luckily, for Jolley the court recognized the necessity to view the 118-page Purchase Agreement. Maybe that’s because WaMu was notorious for offering the same loans in multiple trusts. Just a random survey of WaMu 2006-2007 trusts [CLICK HERE FOR FULL REPORT] turned up over 500 loans in 2 or more trusts. Matt Taibbi was just scratching the surface on what the SEC wasn’t on top of! [Click here for Madoff and the “Aggressively Clueless” SEC].

Wouldn’t you call fabricated assignments and loans assigned to multiple trusts dancing on the fringe of securities fraud? Hello, SEC????

FDIC SEALS INDYMAC DOCUMENTS TOO!

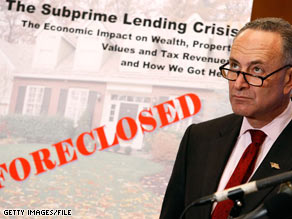

This story probably wouldn’t be so colorful except for the fact that lack of transparency has become a pattern of the FDIC under the Bair rule and beyond. IndyMac Bank, FSB, the  thrift that was seized in mid 2008 after US Senator Charles Schumer (D-NY), a member of the Senate Banking Committee, chairman of Congress’ Joint Economic Committee and the third-ranking Democrat in the Senate, released several letters he had sent to regulators, which warned that “the possible collapse of big mortgage lender IndyMac Bancorp Inc. poses significant financial risks to its borrowers and depositors, and regulators may not be ready to intervene to protect them”. Schumer’s remarks caused people to withdraw their money from the bank and by July 11, 2008, citing liquidity concerns, the FDIC put IndyMac Bank into conservatorship.

thrift that was seized in mid 2008 after US Senator Charles Schumer (D-NY), a member of the Senate Banking Committee, chairman of Congress’ Joint Economic Committee and the third-ranking Democrat in the Senate, released several letters he had sent to regulators, which warned that “the possible collapse of big mortgage lender IndyMac Bancorp Inc. poses significant financial risks to its borrowers and depositors, and regulators may not be ready to intervene to protect them”. Schumer’s remarks caused people to withdraw their money from the bank and by July 11, 2008, citing liquidity concerns, the FDIC put IndyMac Bank into conservatorship.

The FDIC seized all of the books and records making it difficult for former IndyMac Bancorp CEO Michael Perry to even file bankruptcy. Mr. Perry maintains a blog called NOT TOO BIG TO FAIL detailing events and his personal insight. After reviewing the IndyMac December 2007 10K it appears that had TARP been initiated earlier IndyMac may have easily survived.

The takeover of IndyMac was so swift and secretive that by February 2009 [under Obama] the IndyMac Bancorp bankruptcy Trustee had to file a motion for a 2004 Examination and adversary complaint in order to recover information seized by the uncooperative FDIC. The IndyMac bankruptcy trustee’s Complaint [Click here for Complaint PDF] states in paragraph 14:

“At the time the Bank was seized by the OTS and placed into FDIC receivership, the FDIC gained control of the books and records of both the Bank and the Debtor because those books and records were physically maintained at the Bank. Shortly after the Trustee’s interim appointment, the Trustee learned that the Debtor’s books and records were in the FDIC’s custody, control and possession. The Trustee diligently made various attempts to obtain access to the Debtor’s books and records so as to identify, among other things, the Debtor’s assets and otherwise to investigate the financial affairs of the Debtor. Despite such efforts, the FDIC afforded the Trustee only limited access to the Debtor’s books and records.”

The FDIC wasted no time in disposing of the IndyMac Bank assets. The Trustee’s complaint continues:

“15. Upon information and belief, on January 2, 2009, the FDIC signed a letter of intent to sell the banking operations of New IndyMac to a thrift holding company, IMB HoldCo LLC, which is controlled by IMB Management Holdings LP. Press releases issued at or around that time indicated that the Transaction was expected to close in late January or early February 2009.

16. Because (i) the FDIC had not publicly disclosed the letter of intent or documents related to the Transaction, (ii) the Trustee, at that point in time, had only limited access to the Debtor’s books and records and former employees, despite prior requests to obtain access to the same, and (iii) the Schedules of Assets and Liabilities and Statements of Financial Affairs filed by the Debtor were accompanied by broad disclaimers regarding their incompleteness and potential inaccuracies, the Trustee had no means to precisely identify the assets subject to the Transaction or to evaluate the Debtor’s interest in them. However, the limited documents that were in the possession of the Trustee raised concerns that the FDIC, as Receiver for the Bank and Conservator for New IndyMac, may possess assets of the Debtor and, therefore, property of the Estate.”

Accordingly, the bankruptcy Trustee motioned for, and the court ordered, a 2004 Examination. Despite the Order, the FDIC produced documents subject to production under the Order in an untimely fashion, thereby impeding the review and analysis of them by the Trustee that the 2004 Motion and Order contemplated. Much of the securities and other asset information were sealed.

Accordingly, the bankruptcy Trustee motioned for, and the court ordered, a 2004 Examination. Despite the Order, the FDIC produced documents subject to production under the Order in an untimely fashion, thereby impeding the review and analysis of them by the Trustee that the 2004 Motion and Order contemplated. Much of the securities and other asset information were sealed.

A common thread throughout the bankruptcy Trustee’s complaint was, “This paragraph redacted pursuant to the Protective Order and the Court’s directive as set forth in footnote 1, supra. (See Ex. 2.).”

“1 On February 23, 2009, the Bankruptcy Court directed the Trustee to file under seal those textual references within the Trustee’s Complaint for Declaratory Relief, Enforcement of the Automatic Stay, Accounting, and Segregation and Sequestration of Proceeds from Sale Pending Determination of Allocation of Proceeds that the Trustee, in good faith, believes are subject to the Stipulated Protective Order Re: Confidentiality and Non-Disclosures entered into by the Parties on January 27, 2009 (the “Protective Order”). The Bankruptcy Court further directed the Trustee to redact any text in the Complaint that the Trustee, in good faith, believes is subject to the Protective Order. Accordingly in furtherance of the Bankruptcy Court’s directive as well as the Protective Order between the Parties, attached hereto as Exhibit 1, which the Trustee has filed under seal, is a complete and unredacted version of this Complaint. Attached hereto as Exhibit 2, which the Trustee has filed under seal, is a document that contains the text that the Trustee has redacted from the Complaint in the order in which that text would otherwise have appeared in the Complaint (with references to the relevant paragraphs in the Complaint where the text would otherwise have appeared). With respect to the remaining exhibits, to the extent the Trustee believes, in good faith, an exhibit is subject to the Protective Order, it has filed that exhibit under seal and has noted the same herein.”

As the IndyMac bankruptcy Trustee was trying to sort out assets, the FDIC (Bair) was making a sweetheart deal where IndyMac was bought and transformed into One West  Bank by a private equity firm called Dune Capital Management, a group that includes billionaire George Soros and Dell Inc. founder Michael Dell, who agreed to buy the failed bank for $13.9 billion. The bank’s assets at the beginning of this year (2009) totaled $23.5 billion so they made some BILLION$ immediately at the time of purchase. (Refer to the IndyMac Dec. 2007 10K).

Bank by a private equity firm called Dune Capital Management, a group that includes billionaire George Soros and Dell Inc. founder Michael Dell, who agreed to buy the failed bank for $13.9 billion. The bank’s assets at the beginning of this year (2009) totaled $23.5 billion so they made some BILLION$ immediately at the time of purchase. (Refer to the IndyMac Dec. 2007 10K).

“The OneWest profit was reminiscent of those earned by aggressive investors who paid low prices for assets of numerous savings and loans that failed in the 1980s,” printed the LATimes. “But this time, such profit may make the FDIC a lightning rod for criticism of the government’s efforts to clean up the latest debacle. “It makes you wonder whether the [FDIC] loss is due to the acquirer getting too sweet a deal,” Ely said.”

Apparently, George Soros was quite happy with the deal. A spokesperson for Priorities USA Action, the super PAC backing President Barack Obama’s reelection, confirmed to The Huffington Post that billionaire investor George Soros has committed $1 million to the PAC. “I fully support the re-election of President Obama,” Mr. Soros said in the email. Wow!

Apparently, George Soros was quite happy with the deal. A spokesperson for Priorities USA Action, the super PAC backing President Barack Obama’s reelection, confirmed to The Huffington Post that billionaire investor George Soros has committed $1 million to the PAC. “I fully support the re-election of President Obama,” Mr. Soros said in the email. Wow!

Here again, why all the secrecy and lack of transparency?

The FDIC / One West IndyMac Master Purchase Agreement deals with “unassigned records” and the way the contract is worded it’s anybody’s guess what all might actually be in there. It appears that the FDIC and OneWest Bank recognized that IndyMac Bank had not made the mortgage loan assignments to the securitized trusts before the trusts closed years earlier. Now, as the securitization mortgage industry was collapsing it appears the FDIC was participating in fabricated Assignments of Mortgages and Deed of Trusts. Why else would the FDIC need to record a LIMITED POWER OF ATTORNEY [Click here for the LPOA PDF] on July 1, 2010?! Yes, Sheila Bair was still there.

Too much case law to list has established that untimely assignments will not confer standing to these securitized trusts. The Pooling & Servicing Agreement (PSA), requires that the trustee and servicer not do anything to jeopardize the tax-exempt status; PSAs generally state that any transfer after the closing date of the trust is invalid. See DeadlyClear’sThe REMICs Have Failed! [Click here]

Too much case law to list has established that untimely assignments will not confer standing to these securitized trusts. The Pooling & Servicing Agreement (PSA), requires that the trustee and servicer not do anything to jeopardize the tax-exempt status; PSAs generally state that any transfer after the closing date of the trust is invalid. See DeadlyClear’sThe REMICs Have Failed! [Click here]

Generally, New York trust law governs the securitized trusts. That does NOT mean that the FDIC has the power to usurp the federal and state trust laws or fabricate documents – as was spelled out in the LPOA:

The LPOA is outrageous because it asserts the power to “fake” assignments, allonges and endorsements that were apparently NOT made at the time the trusts were formed. Do you think the REMICs and investors have a problem? Well, certainly by law and many of the recent court orders – they sure do!

What further compounds this egregious document is that Ralph Malami, a veteran securitization professional at the FDIC as Manager Capital Markets and Resolutions knew or should have known that the trust controlling documents specifically call for endorsements and assignments to be made as part of the original documents at the time the mortgage loan files are transferred to the trust by the Depositor in return for certificates.

In this LPOA Malami agrees that the attached list of attorneys-in-fact may fabricate these documents from June 19, 2010 through June 19, 2011. Unfortunately, they didn’t stick to that either as you will see further below.

And who were these attorneys-in-fact listed in the LPOA? None other than some of our most famous RoboStars! Erica Johnson-Seck, Bryan Bly, Crystal Moore…just to name a few. Smart judges are catching on. New York Judge Shack certainly gets the fact that this fabricated paperwork is fraudulent [Click here for Erica Johnson-Seck / OneWest story]. Just reading the depositions of Bryan Bly and Crystal Moore – it would be difficult to imagine that anyone would legitimately think of these RoboStars as “Attorney-in-Fact” providing valid federal government documents [Click here for more information on Bryan Bly and Crystal Moore].

It is hard to tell how high up this farce goes – but it was under Sheila Bair who left in 2011 and wrote a book. In her comprehensive new book, Bull by the Horns: Fighting to Save Main Street From Wall Street and Wall Street From Itself, Bair recounts her experiences at the FDIC, her frequent run-ins with banking executives, and with officials such as Treasury Secretary Tim Geithner in the Obama Administration. It appears from an interview on Beast TV that Bair knew just how deceptive the investment banks had been – and that would have to include the fact that assignments of mortgage loans had not been made to the trusts. Click here to view the interview below with Sheila Bair.

The fabrication of documents continues beyond the expiration date of June 19, 2011. A FDIC assignment was recently made in March 2013. Yes, an assignment of mortgage made 8 years AFTER the 2005 securitized trust closed; and 4 years after the assets and files were sold to OneWest Bank… not to mention 2 years after the LPOA expired (maybe they issued a new one – ah, but why bother?).

The questions now are: Why? Was this a conspiracy? Was this to protect the pension fund investors at the expense of the homeowners? And why were these assignments not made at the time the Trusts were formed? Shadow banking, maybe? Hiding the recordation so the banks could create more derivatives without being caught in public records?

The questions now are: Why? Was this a conspiracy? Was this to protect the pension fund investors at the expense of the homeowners? And why were these assignments not made at the time the Trusts were formed? Shadow banking, maybe? Hiding the recordation so the banks could create more derivatives without being caught in public records?

Rep. Marcy Kaptur is right – She said 2 years ago “They Can’t Find The Paper Up There On Wall Street, Make Them Prove They Own Your Loan” (VIDEO)

Quotes…

- “And you’re going to find that they can’t find the paper up there on Wall Street.”

- “Don’t leave your home…because you know what, when those companies say they have your mortgage, unless they have a lawyer who can put his finger on that mortgage, they don’t have that mortgage!”

- “So I say to the American people – you be squatters in your own homes! Don’t you leave!”

Thank you Deontos, JMack and everyone who helped research for this post.

I litigated on a WaMu FDIC JPMorgan assigned to foreclosing agent Fannie Mae for two years with all the evidence right up to our appeals to the Supreme Court for my client and the homeowners civil rights were tromped when the Supreme Court denied this case being heard due to the SJC refusing the case by excepting opposing council opposition to appeal saying it was a discretionary appeal , not a mandatory appeal.

Fannie Mae council gambled on their opposition that was totally incorrect hoping the Supreme court would turn a blind eye and they did.

Thank you Virginia! http://www.nationalwamuhomeownerssupportgroup.com

You are welcome to use my Trust information for any public purpose you deem necessary to expose this crime. =)

Vice Versa, Have a Loan Trust : INDYMAC MORTGAGE LOAN TRUST INDX 2004- AR1. Obtained thru ScreenShots(no longer in Business). Great stuff.

FDIC/FOIA: OneWest Bank, FSB only purchased Servicing Rights in their fabricated Schedule of Loans. In my case, Indy sold the loan to Trust, Indy Retained Servicing Rights, FDIC took over Indy’s Servicing Rights. FDIC sold Servicing Rights to OneWest. LPOA, expired in June 19, 2010, according to FDIC website. Fabricated LPOA expired June 19, 2011 ???

This is noted at the bottom of the Sheila Bair interview! Which is troublesome. Sheila Bair has left millions of families homeless, and millions more going homeless, to save the banks. This is a discredit to her concealment of the crime by the banks.[not worthy of any kind of good credit. [[” It’s worth noting that Bair was one of the only figures in Washington to emerge from the crisis with her reputation intact, and indeed, burnished. Hundreds of failing and faltering banks failed and were closed, with little disruption to customer service. No depositor lost a single penny in insured deposits, despite the worst banking crisis since the early 1930s. The debt insurance program collected several billion dollars in fees without having to make any payments. And the insurance fund run by the FDIC is replenishing itself without having to dun taxpayers. For better or worse, the banking system is now in relatively good health.]]” AND THE PEOPLE ARE RUINED JOBLESS, INCOMES DRAMATICALLY REDUCED, OUR HOMES BECOMING RENTALS, LOSS OF PROPERTY, TERRORISM AT ITS WORST. The banks sure came out ok though. Sheila belongs in jail with the rest of them. Anyone wanting a copy of my investigated trust can email me at Shelleystotalbodyworks@comcast.net. Absolute proof my trust was violated and an attempt to fix the problem years after the PSA was corrupted.

If the depositors would have lost money, FDIC would have had to clean up that mess and would have cost them dearly. By taking out WAMU 8 days before TARP recipients were announced, JPMC could clean up WAMU for almost free (free after TARP, Tax credits, accounting adjustments.) So, everybody wins except for the WAMU homeowners and the WAMU bondholder certificate holders. The one’s who loaned their signatures and the one’s who loaned the initial money all get screwed. God bless ScAmerica. Sheila B was part of the problem, not part of the best solution. She is no angel. This is why FDIC doesn’t help the homeowners with discovery. Doesn’t that make them aiders and abettors?

(FDIC was back-stop regulator to WAMU as well as the (now defunct – how convenient) OTS. Both “regulators” allowed the crime spree to flourish….)

My mortgage was a WAMU mortgage with Chase the FDIC and Deutsche bank pulling a mod fraud on me to steal property they do not own.

Hello Shelley, I am similarly situated….need proof of loan payoff, can you advise?

Miles

N.J. judges have Throat Cancer ! No, they didn’t get it from Lady Liberty.

IndyMac Loan in January 2004. Note & Mortgage acknowledged by an attorney who is in “Retired Status”, not authorized to practice law. “Deposition of attorney” confirms.

Loan with original loan number sold to Loan Trust the following month.

Modification of Loan with new loan number by Indy in 2008, Mods not authorized as per PSA.

Loan sold to FannieMae, March 1, 2008.

FDIC closes Indy July 11, 2008.

OneWest Bank, FSB buys IndyMac Federal Bank, FSB March 19, 2009.

Assignment of Mortgage from FDIC to OneWest August 2010.

N.J., POA must be recorded with an Assignment of Mortgage which was signed by an Attorney-in- Fact.

Perhaps FDIC/Treasury/FED all want to keep up our “vibrant economy” and JPMC’s “fortress balance sheet” strong at the expense of the 70 – 80% of the defrauded WAMU homeowners (crime victims) who were screwed by WAMU’s RICO conspiracy. The WAMU homeowners are expendable in their eyes. Most these WAMU homeowners were victims of mortgage fraud by WAMU’s employees and /or criminal mortgage brokers. WAMU loaned (OTHER PEOPLES’) money to dead people? $8.00 wage earners were approved on $200,000 homes? A Mariachi band member was shown making six figures? WAMU broke the law and enriched themselves. and JPMChase has ZERO investment into these loans (as servicer in WAMU’s Trust shoes) and receives a windfall while screwing the bondholder certificate owners (investors) who are now suing for their losses under warranties and reps per the PSA’s. God bless ScAmerica.

Americans were set up by all the banksters all banks and perhaps Soro’s. It appears Sheila Bair is part of the crime only helping the banks and definitely not the people. Freddie and Fannie had a policy never to accept any notes! How could they security them if they did not accept them?

One scam after another we were used and duped. https://deadlyclear.wordpress.com/2013/01/18/hamp-the-modification-scam-and-now-settlement-sham/

The banks don’t own the loans! It appears it is possible 100 percent of the foreclosures were not in default.

And a document from the OCC stating thirty percent of the homes forclosed on were not in default but stolen by the banks.http://stopforeclosurefraud.com/2013/04/09/foreclosure-settlement-a-nationwide-crime-scene-all-in-w-chris-hayes/

http://stopforeclosurefraud.com/2013/04/11/video-christopher-l-peterson-foreclosure-fiasco-lost-promissory-notes-and-the-mortgage-electronic-registration-system-mers/

FREDDIE AND FANNIE SHELL GAME BY SHAWN NEWMAN.

http://mandelman.ml-implode.com/2011/12/guest-post-welcome-to-freddie-and-fannies-mortgage-shell-game-by-shawn-t-newman-j-d/

FREDDIE AND FANNIE SHELL GAME AND FREDDIE FORECLOSURES BEING DENIED AND REVERSED wd: http://stopforeclosurefraud.com/2013/04/21/phillips-vs-first-horizon-mers-nevada-dist-court-defendants-failed-to-execute-a-valid-nod-prior-to-the-nos-fannie-mae-is-denied-sj/

Subject: Fwd: http://stopforeclosurefraud.com/2013/04/21/phillips-vs-first-horizon-mers-nevada-dist-court-defendants-failed-to-execute-a-valid-nod-prior-to-the-nos-fannie-mae-is-denied-sj/

https://deadlyclear.wordpress.com/2012/03/15/securitized-distrust/#comment-3091

: http://stopforeclosurefraud.com/2013/04/21/phillips-vs-first-horizon-mers-nevada-dist-court-defendants-failed-to-execute-a-valid-nod-prior-to-the-nos-fannie-mae-is-denied-sj/

http://mandelman.ml-implode.com/2011/12/guest-post-welcome-to-freddie-and-fannies-mortgage-shell-game-by-shawn-t-newman-j-d/ FREDDIE AND FANNIE HAD A POLICY [LETTER AVAILABLE IN THIS ARTCLE. ] OF NEVER RECIEVING THE NOTES. Therefore they dont own any notes had zero notes transferred to them timely. Freddie and Fannie are as much the con shell game as is MERS.

An entire county is reversing Freddie foreclosures.

or informational purposes only. http://stopforeclosurefraud.com/2013/04/19/curtis-hertel-jr-ingham-courts-overturn-fannie-mae-evictions-of-county-homeowners/.

Reblogged this on alipav and commented:

Wish I could find my Wa=Mu acct.

Check for it in Morning Star’s Documents. I found mine hidden in there, proving outright fraud. When I alerted the SEC and asked them why they completely different information they didn’t want to talk to me anymore. Caught red handed trying to hide and cover up!

Will I ever receive my money from the FDIC? They still have approximately $61,000.00 when IndyMac Bank failed on July 11th, 2008.

It appears they sold the bank and all the assets and “unassigned records” to OneWest Bank, owned in part by Michael Dell and George Soros… friends of US Senator Chuck Schumer (and President Obama)… shortly after Senator Schumer’s negative remarks about IndyMac. You might want to post something on Mr. Perry’s blog nototbigtofail.org.

Reblogged this on The Black Robed Mafia and commented:

Been a while since this was posted, but well worth the read. Thanks Deadly Clear!!!

Pingback: OneWest “is not above the law” – No Merger For You! Bravo Helen Kelly! | Deadly Clear

Pingback: FEDERAL AND STATE CRIMINAL STATUTES OF LIMITATIONS HAVE NOT EXPIRED FOR PROSECUTING BANK EXECUTIVES FOR MORTGAGE FRAUD | Deadly Clear